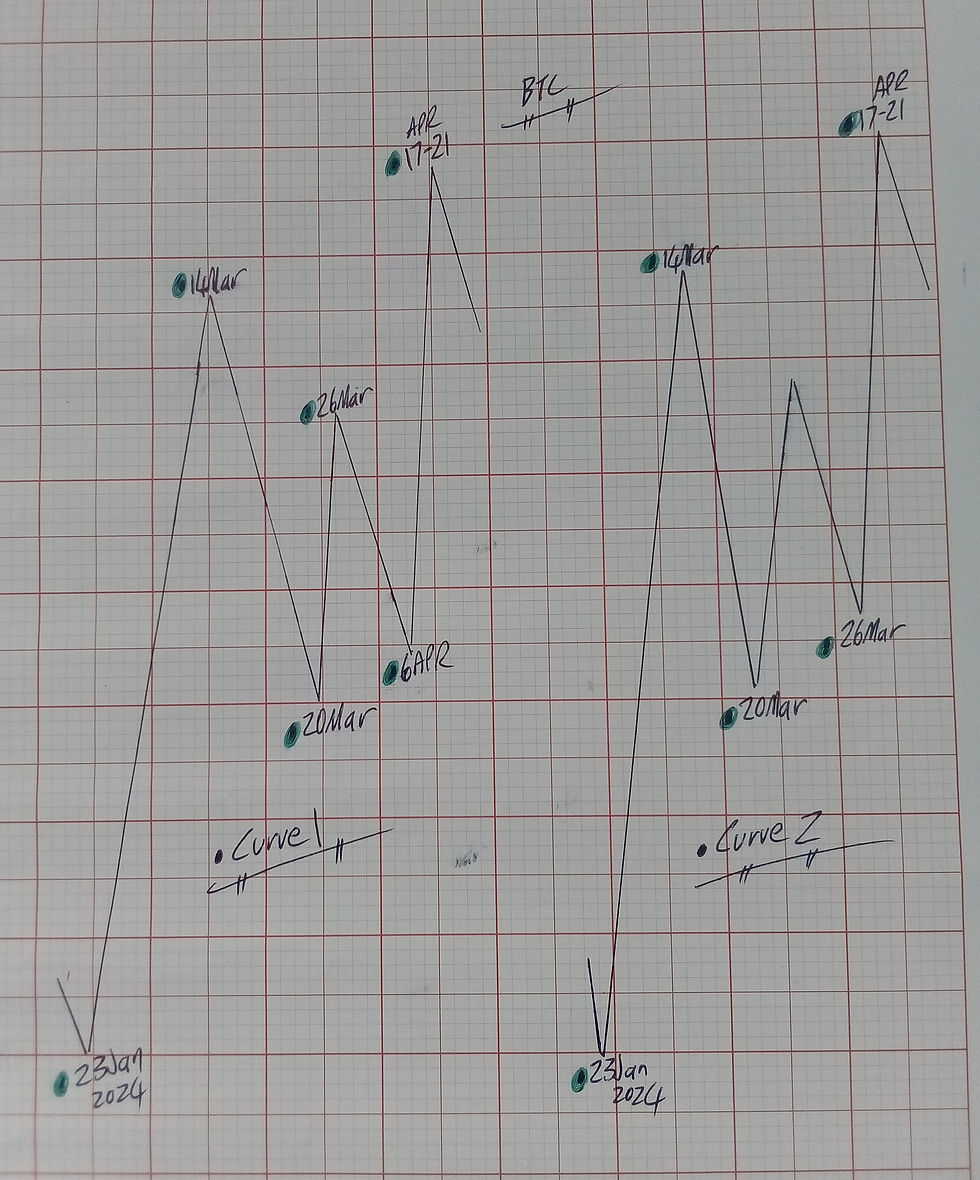

Bitcoin current Low 20th Mar seems to have come in on target followed by a expansion move up. Gann often said that when the time period is up both volume and space movement will follow so this looks to be a good confirmation and the 20th Mar point will be an important date to hold if we are to move higher . Within this Forecast there are three dates to watch and I will try to provide an roadmap as to where each one of these dates could come in . The first date which is only a minor time period is the 26th Mar and at the bottom I have provided two Curves containing all the dates.

Curve No1 :

If current Low holds in place Mar 20th we could be up till Mar 26th where minor Top is indicated then down into Apr 6th which presents as a very strong date so there is a good chance we will get a strong move out of this date then the final date is 17-21st Apr which comes out as a larger Cycle which could see Main Top.

Curve No 2 :

Shows main Low on Mar 20th so we need to hold this date if we are to move higher then the chance of a pullback into Mar 26th followed by a move higher into Apr 6th then Main Top between 17-21 Apr. So the first date to watch in the short term is Mar 26th so if you are already long and price continues up into this date it could be a good point to take some profits especially if we have an extended move up as this could setup as short term Top.

Or if we peel back into this date and it sets up as a small counter trend Low it could provide a good entry point into the trend and a time based stop would be set below this point .

Over the next few sessions we will monitor how the market is moving into this point and hopefully a few days beforehand we should be able to qualify if we are setting up into minor top or pullback low. I would wait for this date to swing around and see where we are positioned as the current leg up looks quite stretched. April 6th is the next big date to watch so if we do make Low into this point it could be a very strong point so lets wait another week or so and see how we are setting up into it.

By studying past movements we can get a line on what to expect in the future . Gann referred to this as form reading which was an integral element in his research and allowed him to identify patterns containing similar time periods and price amplitude. In the notes below I have compared the current section of the market against a past swing which lets us perform some time and percentage calculations. From Low to High that price swing ran out 82 days which is interesting as the projected time period from Jan 23rd 2024 Low to Apr 17th Top measures around 84 days so there could be a matching time sequence between both structures. Note the percentage drop on the second decline at 17% matches the current decline off the Mar 14th Top although the time periods were different - the projected minor run up into Mar 26th measures 6 days against the past advance of 8 days circled which was followed by a -7.8% drop a very minor correction so we could have a similar amplitude decline into Apr 6th which is the strongest of the dates coming up so my strategy would be to hold back for a few more days in case you missed the Mar 20-21 Forecast Low posted on twitter and here and wait for the 26th to come in and see how we are setting up into it and definitely keep some funds aside for Apr 6th which looks very interesting . Looking at the sketch below containing a few notes we the green arrow at E which shows the past correction declined -17.1% in 12 days against the current decline from Mar 14th Top which was also 16.5% a similar magnitude decline. then we had a small run up into F which was an 8 day move which could be similar to ( the potential ) move up into Mar 26th measuring 6 days but of interest is the last campaign ran 82 days low to high against the current projection from Jan 23rd - Apr 17-21 which measures 84 days so that could be a good template to work against . As mentioned earlier it would be wise to wait a few days to see how the 26th Mar sets up but this is only a minor grade Cycle so it may turn out to be nothing but I have listed it and would like to see how we are moving into it before initiating a position . Apr 6th looks to be the main opportunity.

Comments